Sunday 22 February 2009

On Holiday!

I'm currently on Holiday and will be back on Monday/Tuesday and possibly in a position to make some fresh posts. Although I have not been following markets as thoroughly as normal I have managed to read a few German papers and see that the Yen is moving in the right direction. AUDNZD also looks set to have a go at last years high. So good luck for tomorrow.

Labels:

back soon.,

I'm on holiday

Sunday 15 February 2009

European banking system - A potential stress

A good read from Ambrose Evans-Pritchard:

http://www.telegraph.co.uk/finance/comment/ambroseevans_pritchard/4623525/Failure-to-save-East-Europe-will-lead-to-worldwide-meltdown.html

Not sure about the world wide meltdown, but he has some good points.

Enjoy!

http://www.telegraph.co.uk/finance/comment/ambroseevans_pritchard/4623525/Failure-to-save-East-Europe-will-lead-to-worldwide-meltdown.html

Not sure about the world wide meltdown, but he has some good points.

Enjoy!

Labels:

Eurozone - More weakness to come

USDJPY - Will it mimic the USD during a period of weakness?

As mentioned in my post below, I view the strength of the Japanese currency as excessive now. I also note that as the USD has been strengthening the Japanese Yen has been strong, being one of the few currencies that has not weakened versus the USD. If the USD were to weaken again for a period would the JPY weaken with it? Take a look at the chart above. JPY has broken out of a daily trend and has the potential to form a double bottom on the break of 94.63. My own studies point to a volatility break out and given my fundamental position I would favour a move higher. You can wait for confirmation of the double bottom or ease your way in before with a stop under 87.11. Either way this one could motor.

GBPJPY - Does a major exporting nation mired with deflation deserve one of the worlds strongest currencies?

GBPJPY is a pair that I have been following for some time as the structure is very clear and a major extension target near 120.00 has been hit recently. On a fundamental basis, the news from the Japanaese economy has been relentlessly dire, yet the nation has a mighty strong currency. I follow the Yen index and there are signs of a turn, but nothing concrete. There is scope for a double bottom in USDJPY, but that has yet to be confirmed. I will post a chart for those who are interested in my next post. You can make up your own minds. Basically, you have an oversold currency, sterling, versus the darling of the currency market the Yen. Japan as an export driven nation, has experienced a massive contraction in GDP recently and this loss of demand and credit is leading to deflationary pressures again, see :

Thus as strange as it may sound a somewhat controversial trade could be a winner; going long GBPJPY. The recent false break out a falling wedge to 118.78 followed by a sharp recovery is bullish. I would suggest going long GBPJPY for a rebound to the 158.00 region. Entry should be around 126.00 close to the 61.8% retrace of the initial recovery from 118.78 with a stop under the low at 118.78.

A repeated theme on this blog has been the role of exchange rates to stoke GDP. Consumption is dead largely due to deleveraging. Investment will pick up slowly once the saving rates pick up in any economy. We are left with government spending and net exports. Given that the Japanese have tried various forms of fiscal expansion over the last 15+ years, and that they are a major exporting nation, one of the few ways to assist the economy would be via a weakened exchange rate versus most other curencies. It's the race to who can have the weakest currency! On your marks, get set, .....................

Sunday 8 February 2009

AUDUSD - One to watch

AUDUSD has been beaten over the last 9 months as a play on global deleveraging and a contraction in global demand has been deemed negative for the core of the Aussie economy; raw materials. As alluded to in my post below trade continues regardless and will just go from crazy mad (driven by leverage) to more normal levels as consumers and corporations continue to deleverage.

Although I am currently of the view that this process of balance sheet repair will take much longer than a few months, I do believe that there is scope for two way movement in markets, hence my short squeeze view in equities and a potential bounce for the Aussie. I do however reserve the right to change my mind as data changes over time!

So although I am not convinced we have seen a major low in the S&P 500 yet I do think that there may be a tradeable bounce in equities down the pipeline. In this scenario Aussie may fair better than many expect. The only element of the trade idea that bugs me is that the USD index as shown in my post http://you-buy-the-high-i-sell-the-low.blogspot.com/2009/01/usd-index-chart-will-reversal-pattern.html , continues to look menacing and makes me think that a test of the neckline is still possible before the dollar weakens. This has already dented my NZD trade idea.

My warning to readers is that maybe this is just one to watch, but it is exhibiting some good signals for an eventual swing higher. See chart above for some positive signs. Click on chart for larger image.

Baltic Dry freight Index - Possible recovery

Firstly take a look at the following: http://www.bloomberg.com/apps/cbuilder?ticker1=BDIY%3AIND . There does appear to be a minor recovery in this dry freight shipping index, and as a result we have seen a turn around in the AUD and to a degree in equities.

The huge amount of leverage that has been unwound on a global scale led to a sharp dip in demand for dry freight containers as large capital intensive projects were abandoned. It would seem obvious that trade will not end, but going forward may just have to return to more subdued levels that are consistent with consumers and corporations that are paying down debt. This does not mean that container ships will never sail again, just fewer of them. Maybe folk will wait for their fridges to break before buying a new one. You get where I'm going....

It is worth noting this turnaround in the index as it may also signal some kind of rational behaviour is returning to the market place. Although I am not convinced that we have seen a short term bottom in equities, the price action is interesting and I do believe that there is scope for a short squeeze higher in equities, hence my piece on AUDUSD which will follow shortly. In any case food for thought.

The huge amount of leverage that has been unwound on a global scale led to a sharp dip in demand for dry freight containers as large capital intensive projects were abandoned. It would seem obvious that trade will not end, but going forward may just have to return to more subdued levels that are consistent with consumers and corporations that are paying down debt. This does not mean that container ships will never sail again, just fewer of them. Maybe folk will wait for their fridges to break before buying a new one. You get where I'm going....

It is worth noting this turnaround in the index as it may also signal some kind of rational behaviour is returning to the market place. Although I am not convinced that we have seen a short term bottom in equities, the price action is interesting and I do believe that there is scope for a short squeeze higher in equities, hence my piece on AUDUSD which will follow shortly. In any case food for thought.

Wednesday 4 February 2009

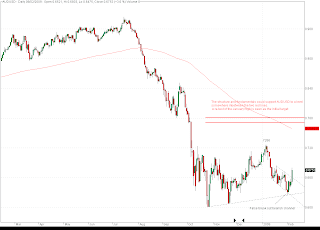

EURGBP - Update, and trading recommendation

As per my posting below ( http://you-buy-the-high-i-sell-the-low.blogspot.com/2009/01/eurgbp-potential-lower-high-in-place-at.html) the expected break of trendline support off .7806 and .8844 has taken place. Examining short term structure, which is not detailed in the chart above, there is scope for today's fall to end close to .8820. If this does take place, then there is a possibility of a three legged correction and a return to the .9000 region. If however .8804 is broken to the downside, a bear flag will be triggered with the associated target lower. There is a reasonable chance of a return back to the .9000+ region hence the trade which is detailed in the chart above. Click on chart for a larger image.

I continue to think that sterling has a great deal of negativity priced in. In the balance sheet recession that we are in it is vital to have the flexibility to implement expansionary fiscal policy, as and when it is needed, (providing the debt capital markets don't punish you too severely for doing so). Given that members of the Eurozone are subject to the budget constraints set out in the Maastricht treaty this could turn out to be yet another item to add to the growing list of negatives for the Euro going forward.

Subscribe to:

Posts (Atom)