Monday 10 August 2009

Adam Posen has an impact on the MPC

As per the following link it appears that others are also thinking along the lines of my recent post. Check out this Telegraph article.

Labels:

Adam Posen and GBPUSD

Sunday 9 August 2009

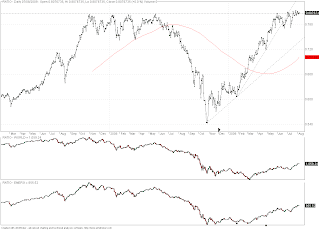

Emerging versus developed equity markets - An update.

As was explained in my post below I believe that the risks in US equity markets are skewed to the downside at current prices. I thus contunue to think that anyone with the long emerging versus short developed trade should consider reversing it as per the evidence in the chart above. Basically if equities in general are set to weaken then developed markets will outperform their emerging cousins.

Labels:

Emerging/World ratio - An update

GBPUSD - The probability of a return to 1.3500 and then lower is not negligible.

As returning readers will know I have been prematurely bearish on cable a couple of times. However, this is not going to stop me from getting even more bearish again! The price action seen in GBPUSD and infact in all currencies versus the USD on Friday suggests that there is likely to be a pause in USD weakness and even possibly some strength (my favoured outcome). This ties in to equity markets too. The S&P 500 has now met the 38.2% retrace of the fall from the highs back in 2007.

I agree with the analysis provided by David Rosenberg via Michael Shedlock which you can view here, that the S&P500 is now priced for perfection and that the probability of perfection is as good as nil. I am thus inclined to think that risks are heavily skewed to the downside in equities and thus my USD bullish stance as per my prior post. So what has this got to do with cable? Well, I think that if there is a return to USD strength that it could be a substantial move and that the probability of a return to 1.3500 is a lot higher then is currently priced in and infact a target closer to 1.2600 is even feasible.

The Bank of England have recently hired a new MPC member by the name of Adam Posen. If you pressed on the link you will have learnt that he is an expert on Japan. Furthermore we should not have been surprised to learn of the expansion of the QE program last Thursday. What I am pointing out is that I believe that the BOE percieves the risk of a Japanese style deflationary spiral as far greater then they even want to admit to. As has been alluded to time and again on this blog that is my belief too. So ask yourself this; with the amount of public and private debt outstanding in the uk does cable deserve to be near 1.7000? The bank of England has not hired a Japanese expert by chance. This is essentially an admission that the probability of a Japanese re-run in theUK is far greater then most believe.

As can be seen on the chart above cable has failed to close above the 61.8% retrace of the 1.8672-1.3500 fall. This maintains bearish structure and leads me to favour a return towards 1.3500.

Saturday 1 August 2009

India's Nifty Fifty - Another good shorting opportunity

As per my earlier posts, some of you will know that I am short term bearish on the NSEI Nifty 50. I think that that the closing levels seen last Friday offer another good short entry point. For a return to the 3600 region. Above I am showing the index versus the p/e ratio for those that are interested and follow such data. I would place a stop above 4970. Good luck to anyone who has a go.

Subscribe to:

Posts (Atom)