GBPJPY is a pair that I have been following for some time as the structure is very clear and a major extension target near 120.00 has been hit recently. On a fundamental basis, the news from the Japanaese economy has been relentlessly dire, yet the nation has a mighty strong currency. I follow the Yen index and there are signs of a turn, but nothing concrete. There is scope for a double bottom in USDJPY, but that has yet to be confirmed. I will post a chart for those who are interested in my next post. You can make up your own minds. Basically, you have an oversold currency, sterling, versus the darling of the currency market the Yen. Japan as an export driven nation, has experienced a massive contraction in GDP recently and this loss of demand and credit is leading to deflationary pressures again, see :

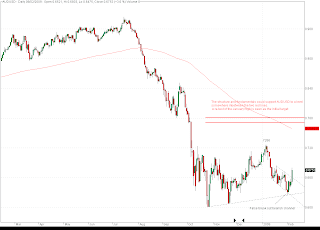

Thus as strange as it may sound a somewhat controversial trade could be a winner; going long GBPJPY. The recent false break out a falling wedge to 118.78 followed by a sharp recovery is bullish. I would suggest going long GBPJPY for a rebound to the 158.00 region. Entry should be around 126.00 close to the 61.8% retrace of the initial recovery from 118.78 with a stop under the low at 118.78.

A repeated theme on this blog has been the role of exchange rates to stoke GDP. Consumption is dead largely due to deleveraging. Investment will pick up slowly once the saving rates pick up in any economy. We are left with government spending and net exports. Given that the Japanese have tried various forms of fiscal expansion over the last 15+ years, and that they are a major exporting nation, one of the few ways to assist the economy would be via a weakened exchange rate versus most other curencies. It's the race to who can have the weakest currency! On your marks, get set, .....................