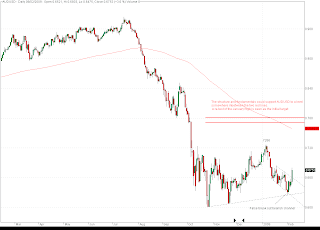

AUDUSD has been beaten over the last 9 months as a play on global deleveraging and a contraction in global demand has been deemed negative for the core of the Aussie economy; raw materials. As alluded to in my post below trade continues regardless and will just go from crazy mad (driven by leverage) to more normal levels as consumers and corporations continue to deleverage.

Although I am currently of the view that this process of balance sheet repair will take much longer than a few months, I do believe that there is scope for two way movement in markets, hence my short squeeze view in equities and a potential bounce for the Aussie. I do however reserve the right to change my mind as data changes over time!

So although I am not convinced we have seen a major low in the S&P 500 yet I do think that there may be a tradeable bounce in equities down the pipeline. In this scenario Aussie may fair better than many expect. The only element of the trade idea that bugs me is that the USD index as shown in my post http://you-buy-the-high-i-sell-the-low.blogspot.com/2009/01/usd-index-chart-will-reversal-pattern.html , continues to look menacing and makes me think that a test of the neckline is still possible before the dollar weakens. This has already dented my NZD trade idea.

My warning to readers is that maybe this is just one to watch, but it is exhibiting some good signals for an eventual swing higher. See chart above for some positive signs. Click on chart for larger image.

No comments:

Post a Comment