My mother often used to say to me; "do anything in haste and repent at your leisure". As a trader I have learnt the truth of this phrase. Any trader out there will appreciate the impact of this saying, when he/she has jumped into a market on an impulse and then had to take a stop and nurse the psychological wounds at their leisure. Well, in much of the developed world we have all become traders, betting on house prices, pension funds and any asset that will yield to the ravages of leverage. Well at least that was the way it was until recently.

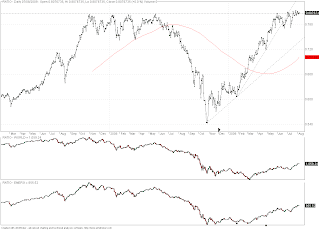

So lying in bed I thought what picture could I use to encapsulate the title of this particular piece and from out of my subconscience came a floating monthly chart of the Nikkei. Perfect:

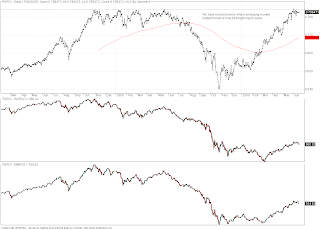

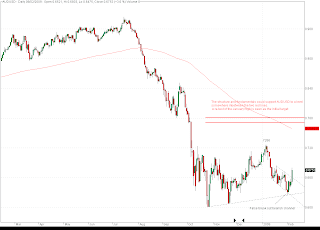

So where is this all going you may ask. Well there has been a lot of press about the rise in US 10 year yields. This got me thinking about how sustainable the current bond yield move is. What followed in my mind was a philosophical debate about what deflation actually is. Big picture, I believe that deflation is a way of controlling the animal instincts of fear and greed that lead people to flip houses, bid up tulip bulbs and price palaces in downtown Tokyo at values greater than the state of California. It is a mechanical restorer of equilibrium, but it takes time. As can be seen in the chart above, after the initial collapse in the Nikkei in the late 80's there have been many false dawns where the animal instinct has been beaten back and my mothers wise words have been repeated. Could it be that every time the Nikkei rose, the bond market sold off, as this was perceived to be the beginning of a new bull market? Then yields got to a point where, deleveraging became slower and began to hamper the economy (again) thus setting off another mini-crisis and fresh lows. If you are a zombie bank and the rate at which you can roll over your debt suddenly rockets any hopes of expansion and new hiring are thrown out of the window. Consumers who have mortgages also begin to feel the pain.

The point I am trying to make here is that the biggest credit bubble in the history of the world cannot be cleansed by a group of central bankers buying shed loads of bonds. Mr &Mrs consumer and the corporations that employ them first need to pass through years of balance sheet repair. It is thus my assumption that, as happened in Japan, we will undergo further setbacks which will drag yields lower until we are all in a position to comfortably pay down debt. It is essentially a self induced viscious cycle where premature risk taking stokes the animal instincts that have not quite been extinguished from the last pasting, the herd jumps in and then yields rise and ooops premature tradeaculation, those yields at what would, in a historic context, be considered low levels, lead to a reversal of enthusiasm and back down we go. Eventually you have had so many beatings your psychology changes and the end result is a chart called the Nikkei.

The alternative is a biblical style of debt cleansing where the consumer and corporate debt slate is wiped clean. How would our high street banks feel if we just walked away from our debts, well for a start they could not pay their staff wages. You get where this is going. So deflation forces upon us a Yin phase in the economy (see post below), where yields stay low for a long time but despite low interest rates nobody wishes to leverage themselves up to the eyeballs. So you only need a few false dawns as happened with the Nikkei and pretty soon phsychology has changed and we are all left reflecting why we jumped in so soon. Why did we not listen to our mothers!

Another phrase my mother used to say to me was; "if you can't say anything nice, don't say anything at all". Sorry mum.