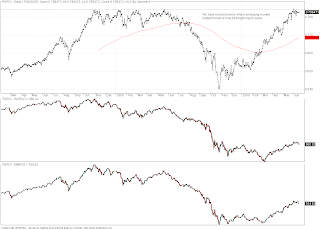

Above you can see three charts all in the one frame. The orientation of the data is as follows, starting from the bottom we have the Morgan Stanley Emerging markets index, above that the World index from the same provider, and right at the top we have the ratio of the two, calculated by dividing the value of the emerging markets index by the world index (developed markets).

As the ratio rises this is showing you that emerging markets are outperforming developed markets and this has been the case since the end of October last year when the emerging market index bottomed. Note that the world index made a fresh low after October, in March which was not matched by the emerging world. Conversely when the ratio falls the opposite is true. In that case developed markets will outperform.

Although I appreciate there is not a lot of history we can see that when the ratio hit these levels last year it marked a high point for equities and the end of the outperformance of the emerging markets. Given my view on some emerging markets and India in particular I think that we could see outperformance again in developed markets. I feel that the S&P must at the very least test the low that was made in March, be it a 50%/60% or greater retracement. If that is the case emerging markets are not the place to be in the short run.

I would like to stress that I am a long term bull on the Indian markets in general, but feel that we have gone a long way in a short while on essentially hot air as per my recent posts.

No comments:

Post a Comment