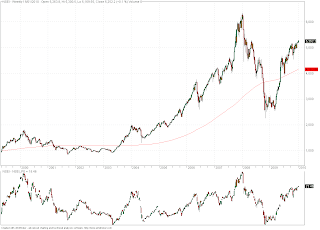

Its is said a picture speaks a thousand words, so above I present a picture I have become quite fond of. The nifty is shown in the upper portion of the image with the p/e showing at the bottom.

Now, if there is anyone that can justify to me that there is any value in the Indian stock market then please let me know (seriously, send me an e-mail). The only times that the P/E has been higher then it is today was in the bubbles of the tech boom and the one that was driven by the biggest credit bubble in the history of the world, in 2007. I can only repeat the sentiment from my previous post. If you are a long term investor who likes to sit on value based positions, this is highly unlikely to be the time to invest in Indian equities.

I have read countless articles about the way retail investors are piling into emerging markets and Indian equities in particular. Remember:

1. Market sentiment is almost always most bullish at tops. It must be to get the greedy to buy

2. There is no such thing as decoupling.

Mind how you go....

it will really helpful if you put the wave analysis chart for sensexxxxxxxxxxx because i dont find about the elliot wave report in india......

ReplyDeleteregards,

Gansh

I absolutely agree that Nifty is its peak and getting into market for mindless gains would be foolish. But i do believe that one can always find selective stocks for longer term. Could give you some useful research articles written by our research team. Lemme know if interested.

ReplyDelete