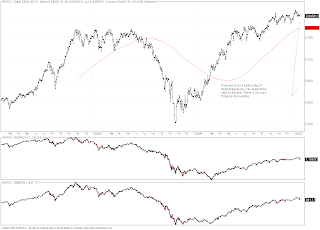

Above is a chart that I have shown on this blog before. It basically divides the value of the Morgan Stanley World index by the Morgan Stanley Emerging index. This is shown at the top of the chart. Below are the world and emerging indices. Click on image for a larger chart.

It is clear, from what data we have, that during bullish phases in equities the ratio rises, so emerging outperforms. Converely during periods of equity weakness emerging markets underperform their developed world cousins.

Now if you believe that we are in for a new wave of deleveraging then there is a greatly increased probability that the ratio heads south, ie emerging underperforms. There is no such thing as decoupling. At the very best a variation of decoupling may take place over decades where the ratio always peaks at higher levels and forms higher lows at higher levels. It remains to be seen if this is the case.

No comments:

Post a Comment